October Monthly Vanadium News

As Autumn unfolds its colours, the vanadium market continues to face headwinds from a decline in demand from the steel industry. Prices have further decreased over the past month and the short-term outlook seems challenging. However, looking ahead and past these current difficulties, vanadium demand continues to grow from flow batteries. LPV celebrates notable advancements and significant milestones that highlight vanadium’s increasingly critical role towards a renewable and resilient energy future. | ||

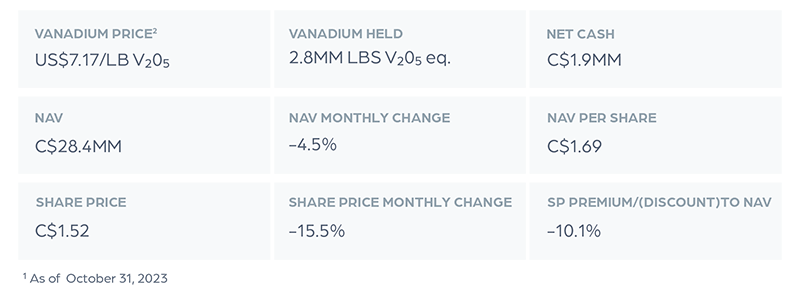

Going with the flow Foremost among the exciting news is the substantial progress in large-scale energy storage projects in China. The inauguration of the Huayong Group's vanadium flow battery power station in Harbin represents a leap forward for the technology. With a staggering investment of 750 million yuan, this 50MW/200MWh project not only stands as the second largest of its kind globally but also a benchmark for vanadium's application in green energy. Complementing this is another landmark agreement signed by Shandong Flow Battery Energy Storage Company for a colossal 100MW/400MWh vanadium flow battery energy storage demonstration project in Weifang City. This endeavor, which is currently the largest planned flow battery energy storage power station in Shandong Province, marks a significant milestone, reinforcing our belief in vanadium as the backbone for renewable energy solutions. These two projects alone are poised to transform local economies, boost industrial growth, and catalyze the development of the entire vanadium flow battery industry chain. It's a compelling narrative that underscores our strategic focus on the vanadium sector. Taiwan is also a strong contender in the energy revolution, with Invinity Energy Systems reporting the sale of 1.1 MWh toTaiwan’s National Applied Research Laboratories. Taiwan's vision to fortify its infrastructure with vanadium batteries not only reflects growing confidence in vanadium's reliability and safety but also aligns with global initiatives to decarbonize electricity grids. The momentum continues with Thorion Energy's decision to situate its vanadium battery manufacturing in Vietnam, hinting at a future where vanadium batteries are ubiquitous across the continent. While celebrating the large-scale applications in Asia, let's not overlook progresses made in other regions. A forecast from Fact.MR indicates a burgeoning market, ripe with opportunity in North America with the vanadium electrolyte market advancing at a 9.9% CAGR to potentially reach US$570 million by 2033. At Largo Physical Vanadium, these developments resonate with our core mission. The success of these projects not only validates our thesis but also enhances our determination to foster a more sustainable energy future. As always, we are committed to keeping you informed and engaged as we navigate this dynamic landscape. Together, let's embrace the change and the opportunity it brings. Largo Physical Vanadium Update - October 2023¹ LPV’s net assets are over 95% held in physical vanadium products. LPV’s net asset value (“NAV”) is now at C$1.80/share, implying that our closing share price as of October 31, 2023, was trading at a 2.3% premium.

1.1 MWh Sale for Taiwanese National Technology Laboratory  Aussie vanadium battery manufacture bound for Vietnam  Tranvic Group’s 3,500 cubic meter vanadium electrolyte project has started trial production  Vanadium Electrolyte Market Advancing at 9.9% CAGR to Attain US$ 570 Million by 2033: Fact.MR Analysis  Invinity chief says vanadium presents ‘a real alternative’ to lithium batteries  Vanadium vs Niobium: Diverging paths?  China’s second largest shared energy storage project Huayong Group vanadium flow battery power station settled in Harbin Acheng District  100MW/400MWh! Shandong Flow Battery Energy Storage Company signed a vanadium flow battery energy storage demonstration project with Weifang City  Going with the flow to run renewables round the clock  Nevada Vanadium Mining Corp. Achieves Milestone as Record of Decision Issued by BLM for Gibellini Vanadium Project

|