November Monthly Vanadium News

November has been another tough month for vanadium prices, which has impacted our share price performance. However, we continue to share the latest developments in the vanadium landscape, spotlighting strategic shifts and collaborative strides that are shaping the future of vanadium.

Navigating Vanadium Trends and Transformations

The inauguration of Jiangsu Meimiao's gigawatt-scale vanadium redox flow battery factory, located in Hualuogeng High-tech Zone, represents its commitment to greener innovation and the industry’s evolution towards intelligent manufacturing of stationary storage.

Guorun Energy also announced a 1GWh manufacturing project in Wenzhou, an initiative that cements China’s position as the global leader in vanadium technology, while showcasing its dedication to innovation and sustainable energy solutions.

Another ambitious manufacturing project by ShaanxiJutai's in Tongguan extends beyond production; it outlines a blueprint for anew era in vanadium manufacturing, aligning with the industry's scaling demands.

Still in China, VRB Energy proudly announced the 10-year review of the GEN1 battery at Zhangbei, reinforcing vanadium's viability in long-duration energy storage. This achievement positions vanadium not just as a competitor, but a leader in a landscape currently dominated by lithium-ion batteries.

As the vanadium industry faces strong headwinds, Bushveld entered into a definitive agreement for the sale of its Vanchem business toSouthern Point Resources (SPR) and initiated a sale process for its stake inCellCube to focus on its core assets.

Furthermore, Neometals had to confront market realities and made the decision to halt the VRP1 project in Finland. It prompts reflection on the sector’s ability to meet the long-term needs for vanadium while short-term prospects are bleak.

On a collaborative note, Tivan’s partnership with Larrakia Energy paves the way for Australia's largest vanadium electrolyte facility. This collaboration is another stride towards fostering low-emissions energy andcritical minerals processing in Australia.

In Southeast Asia, VFlowTech's deployment of vanadium flow batteries in Pulau Ubin showcases its role as enablers in the region's energy transition.

As the sector navigates these trends and transformations, we remain committed to unlocking the full potential of vanadium, steering our investments towards a future where vanadium stands as a beacon in the global energy landscape.

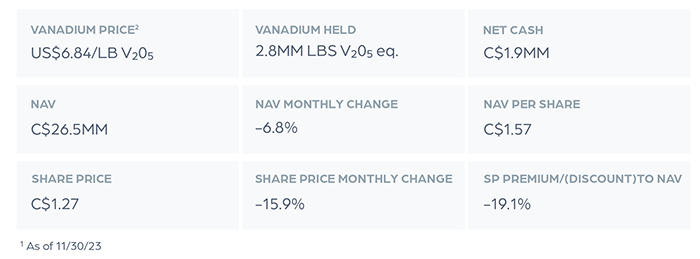

Largo Physical Vanadium Update – November 2023¹

LPV’s net assets are over 95% held in physical vanadium products. LPV’s net asset value (“NAV”) is now at C$1.57/share, implying that our closing share price as of November 30, 2023, was trading at a 19.1% discount.

About Largo Physical Vanadium Corp. |

Largo Physical Vanadium Corp. (LPV) is a pure-play physical vanadium investment company. LPV provides direct exposure to vanadium through a secure, convenient and exchange-traded vehicle. Vanadium is essential to achieving a greener world, though carbon reduction, in key industries such as steel, aerospace and energy storage. LPV's strategy is to achieve appreciation through the acquisition of vanadium as well as actively supplying the fast growing vanadium redox flow battery (VRFB) industry to advance the integration of renewable energy in long duration storage. LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com Paul Vollant, ¹ Key Metrics (as of November 2023 closing) ² LPV’s marked to market average vanadium price blending various products and geographies |