June Monthly Vanadium News

Several exciting developments have taken place in the vanadium industry this month, further solidifying vanadium as a commodity driving a more sustainable and energy-efficient future.

Vanadium prices remained generally stable in June; however, we have started to observe recent price increases, especially in vanadium oxide products for aerospace and battery applications.

Vanadium: The Rising Star in the Energy Storage Sector

In June, certain milestones and market indicators reinforced the vital role vanadium has for the energy storage landscape. One of the most significant developments was reported estimates by RBC Capital Markets (Europe) indicating a vanadium market deficit from 2025 onwards. This expected deficit is attributed to increasing demand from both the steel industry and notably, vanadium redox flow batteries (“VRFBs”), a segment we are particularly excited about.

These estimates also highlight the substantial demand growth driven by new VRFB deployments in the medium term, with an expected CAGR of +14% to 2030. This trend is consistent with the increasing global focus on renewable energy and the demand for efficient, long-lasting energy storage systems.

In Australia, the country's first commercial VRFB project was completed this month in South Australia, underscoring the viability and growing acceptance of vanadium-based energy solutions worldwide.

On a similar note, the U.S. Department of Energy (“DOE”) recognized long-duration energy storage as a critical technology. In a move aimed at accelerating the commercialization of long-duration energy storage, the DOE signed a memorandum of understanding with several agencies, confirming the commercial viability of non-lithium-ion battery asset classes, including VRFBs.

Meanwhile, China’s energy overhaul—a $7 trillion plan to achieve energy independence, has led to a surge in Chinese enterprises expanding into the energy storage sector. The number of companies registered as energy storage companies has more than doubled over the past three years, highlighting the explosive growth in this sector and the opportunities it presents.

In summary, we are on the brink of a transformative era in the energy storage sector, particularly with vanadium playing a critical role. As these developments unfold, Largo Physical Vanadium (“LPV”) remains committed to leveraging these opportunities and is poised to grow alongside this burgeoning industry.

On behalf of LPV, I extend my gratitude for your continued support, and I eagerly look forward to providing you with our next update in the coming month.

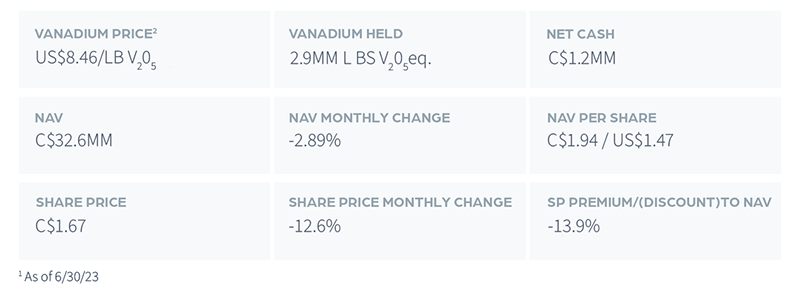

Largo Physical Vanadium Update - June 2023¹

LPV’s net assets are over 90% held in physical vanadium products. LPV’s net asset value (“NAV”) is now at C$1.94/share, implying that our closing share price as of June 30, 2023, was trading at a 13.9% discount.

Based on the NAV to share price discount discussed in our last note, we continue to believe that this investment offer is even more attractive to current and potential LPV investors. A number of corporate initiatives and a marketing campaign are currently underway to raise awareness of LPV and close the valuation gap.

Upcoming Conferences:

Rule Symposium - Natural Resource Investing

Sunday, July 23 - Thursday, July 27, 2023

Boca Raton, Florida, USA

REGISTER HERE

Recent Vanadium News

DOE recognizes long duration energy storage as a critical technology

China’s $7tn energy overhaul sparks battery ‘gold rush’

Australia's first commercial vanadium-flow battery storage completed in South Australia

Largest vanadium flow battery in Southern Hemisphere ready to go live at Port Pirie

Vanadium flow battery firm Invinity expands Vancouver plant to 200MWh

About Largo Physical Vanadium Corp.

Largo Physical Vanadium Corp. (LPV) is a pure-play physical vanadium investment company. LPV provides direct exposure to vanadium through a secure, convenient and exchange-traded vehicle. Vanadium is essential to achieving a greener world, though carbon reduction, in key industries such as steel, aerospace and energy storage. LPV's strategy is to achieve appreciation through the acquisition of vanadium as well as actively supplying the fast growing vanadium redox flow battery (VRFB) industry to advance the integration of renewable energy in long duration storage.

LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com

Paul Vollant,

Chief Executive Officer

pv@lpvanadium.com

Click here for a complete listing of Largo Physical Vanadium's press releases.

¹ Key Metrics (as of June 30th, 2023 closing)

² LPV’s marked to market average vanadium price blending various products and geographies