April Monthly Vanadium News

It is my pleasure to share with you another monthly vanadium market update, including some further updates on Largo Physical Vanadium.

Vanadium prices fell by approximately 6% this month on the back of lower short-term demand in the steel market. However, we believe that medium-and long-term fundamentals for vanadium remain strong and unchanged, with strong growth in demand expected from battery applications in the future.

Big Players Support VRFBs

In April, large Chinese groups such as Shanghai Electric, the country’s multinational power company and world’s largest manufacturer of steam turbines, as well as Rongke Power and Legend Capital made significant commitments to develop their vanadium redox flow battery (VRFB) businesses.

In the US, the Department of Energy (DOE) recognized the potential for flow batteries to provide grid storage and onsite storage at off-grid locations, providing approximately US$16 million in funding as well as the opportunity to establish partnerships between the industry and the country’s National Laboratories. Government support will be crucial to maximizing VRFB potential in the USA and closing the gap with China, which is likely a few years ahead of the rest of the world.

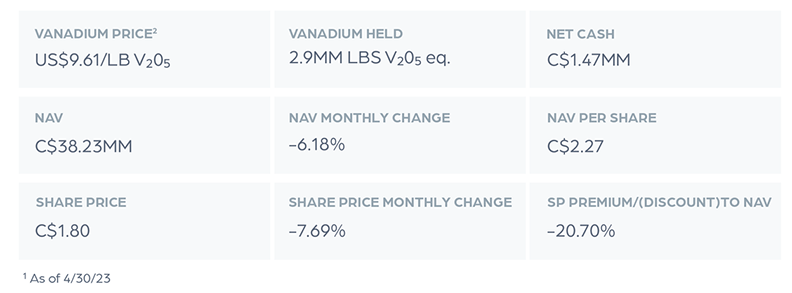

Largo Physical Vanadium Update - April 2023¹

LPV’s net assets are over 90% held in physical vanadium products and near-term delivery commitments. The launch of LPV in September 2022 occurred during a period of lower vanadium prices, which enabled LPV to purchase vanadium units at a favorable price. LPV’s net asset value (“NAV”) is now at C$2.27/share, implying that our closing share price as of April 30th, 2023 was trading at more than 20% discount.

Based on the NAV to share price discount discussed in our last note, we continue to believe that this investment offer is even more attractive to current and potential LPV investors. A number of corporate initiatives and a marketing campaign are currently underway to raise awareness of LPV and close the valuation gap.

Upcoming Conferences:

Metals & Mining Hybrid Investor Conference

Thursday, May 11th, 2023

New York, NY, USA / Virtual

REGISTER HERE

International Flow Battery Forum

Monday, June 26 - Thursday, June 29, 2023

Prague, Czech Republic

REGISTER HERE

Rule Symposium - Natural Resource Investing

Sunday, July 23 - Thursday, July 27, 2023

Boca Raton, Florida, USA

REGISTER HERE

Recent Vanadium News

Largo Reports First Quarter 2023 Operational and Sales Results

100MW/600MWh! The vanadium redox flow battery energy storage power station invested by China Vanadium Energy Storage Co.,Ltd. and Shanghai Electric started construction

Polaris Energy Storage Networklearned that on April 10, Jilin Province started a record-breaking 108 newenergy projects, with an installed power generation capacity of more than 7million kilowatts and a planned investment of 25.2 billion yuan this year.China Vanadium Energy Storage (Hubei) Technology Co., Ltd. and ShanghaiElectric Group Co., Ltd. invested in constructing a 100MW/600MWh vanadium redoxflow battery energy storage power station in Baicheng. It can also beunderstood as a super "clean energy" power Bank".

Xie Guangguo, chairman of China Vanadium Energy Storage (Hubei) Technology Co.,Ltd., said in an interview that China is building a new power system with new energy as the main body. The intermittent and random characteristics of wind power and photovoltaics have brought new opportunities for the development of the energy storage industry. Compared with other energy storage technologies, the all-vanadium redox flow battery energy storage technology has higher security and great development potential.

Scientists Accidentally Discovered New Material That Can ‘Remember' Like a Brain

Vanadium: the new kid on the East London renewables block

Invinity moves to 30-50MWh deployment sizes with UK project, targets 100MWh+ by 2025

Flow battery sector responds: We can meet specs for 513MW South Africa tender

Indian vanadium battery manufacturer inks agreement with Technology Metals Australia

Rongke Power just raised over RMB1 billion weeks ago in their round B led by Legend Capital

US DOE offers funding for flow battery scale-up while providers make inroads in California market

About Largo Physical Vanadium Corp. |

Largo Physical Vanadium Corp. (LPV) is a pure-play physical vanadium investment company. LPV provides direct exposure to vanadium through a secure, convenient and exchange-traded vehicle. Vanadium is essential to achieving a greener world, though carbon reduction, in key industries such as steel, aerospace and energy storage. LPV's strategy is to achieve appreciation through the acquisition of vanadium as well as actively supplying the fast growing vanadium redox flow battery (VRFB) industry to advance the integration of renewable energy in long duration storage. LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com Paul Vollant, ¹ Key Metrics (as of April 30th, 2023 closing) ² LPV’s marked to market average vanadium price blending various products and geographies |