March Monthly Vanadium News

I am pleased to provide you with another exciting vanadium market update, including additional LPV progress over the past month.

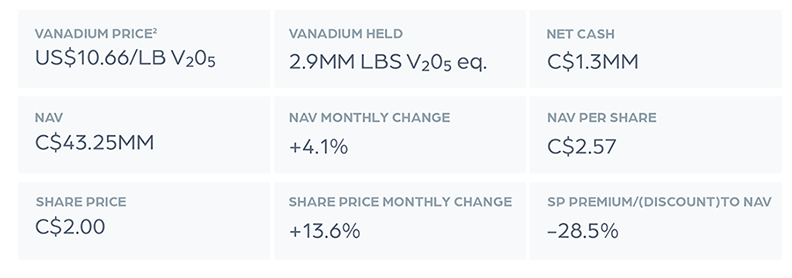

In February 2023, vanadium prices continued to strengthen and increased approximately +4.1% this month.

VRFBs set to dominate vanadium demand growth in 2023.

The announcement of several large VRFB projects, particularly in China this month, (see News below), further support our high expectations for this industry to transform the vanadium market over the coming months and years. As noted in our previous market update, new VRFB deployments in China could total around 2 GWh in 2023 or 10% of global vanadium output. Moreover, recent announcements from China indicate that VRFB manufacturing capacity of approximately 20 GWh could be in place within the next few years. To put this into perspective, from the advent of the VRFB in the 1980s to the end of 2021, there have been approximately 400 MWhs of VRFBs installed around the globe. A total of 400 MWhs of VRFB deployments were completed in 2022 alone, effectively doubling the number of deployments over the past 40 years in just one year. |

More importantly, it is estimated that another 2 GWh of VRFBs will be installed in 2023, a 2.5x increase over historic installations. Historically, VRFBs have accounted for approximately 1-2% of global vanadium consumption. By 2022, this number is estimated to be around 6%. In 2023 alone, it could represent almost 10% of global vanadium consumption. |

Outside of China, investments and government support is also growing as long duration energy storage is becoming a key priority towards decarbonization. Demand from other key markets, including the steel, aerospace and chemical sectors, has also been stronger amid an increased inflationary environment. Specifically, after the lows of 2020 and 2021, aerospace demand has rebounded faster and stronger than expected and is expected to reach pre-COVID levels this year. According to market sources, this return of demand was not previously expected until 2025 or 2026. |

March LPV Update & Metrics¹

LPV’s net assets are now over 90% held in physical vanadium products and near-term delivery commitments. LPV benefited from the fact that its launch in September 2022 coincided with a period of lower vanadium prices, which enabled LPV to purchase vanadium units at favorable market conditions. Our net asset value (“NAV”) is C$2.57/share, or 29% above our closing share price as of February 28th, 2023.

As discussed in our last note, we continue to believe this NAV to share price discount offers current and new LPV investors an even more attractive investment case. We are now in the midst of a marketing campaign to raise awareness of LPV and close the disconnect with our valuation.

Upcoming conferences to be attended by management are listed below:

12th Vanitec Energy Storage Committee Meeting / 2023 International Conference on VRFBs

Wednesday, March 15 to Thursday, March 16, 2023

Chengdu, China

REGISTER HERE

Paydirt’s 2023 Battery Minerals Conference

Tuesday, March 21 to Wednesday, March 22, 2023

Pan Pacific, Perth, Australia

REGISTER HERE

On behalf of LPV, I thank you for your support and look forward to providing a new update next month.

Sincerely,

Paul Vollant

CEO & Director

Largo Physical Vanadium

Recent Vanadium News

2GWh vanadium redox flow battery energy storage power station

Canada’s first commercial vanadium recovery plant gets Emissions Reduction Alberta funding

U.S. energy storage market set for take off

Sumitomo Electric to expand US flow battery business

World Bank: South Africa could ‘play significant role’ in global battery value chain by 2030

About Largo Physical Vanadium Corp. |

Largo Physical Vanadium Corp. (LPV) is a pure-play physical vanadium investment company. LPV provides direct exposure to vanadium through a secure, convenient and exchange-traded vehicle. Vanadium is essential to achieving a greener world, though carbon reduction, in key industries such as steel, aerospace and energy storage. LPV's strategy is to achieve appreciation through the acquisition of vanadium as well as actively supplying the fast growing vanadium redox flow battery (VRFB) industry to advance the integration of renewable energy in long duration storage. LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com Paul Vollant, ¹ Key Metrics (as of February 28th, 2023 closing) |