May Monthly Vanadium News

I am thrilled to present our latest monthly vanadium market update, featuring significant developments regarding Largo Physical Vanadium Corp. (“LPV”).

During the past month, vanadium prices declined approximately 12% due to lower short-term demand in the steel market. However, we have observed recent stabilization, and firmly believe that the medium- and long-term fundamentals for vanadium remain unchanged. Battery applications are expected to experience robust demand growth in the coming years, making the sector an appealing prospect for the future.

Putting Vanadium on the Global Stage

In May, LPV achieved a major milestone by listing on OTCQX under the ticker symbol VANAF. This strategic move enables retail investors in the United States to trade and hold custody of LPV shares securely and efficiently. We are confident that LPV presents a distinctive and valuable opportunity for long-term strategic investors with a belief in real assets and a commitment to decarbonization.

At LPV, we are committed to providing our investors and the public with transparent and comprehensive information about our industry, which is relatively unknown to many. We recognize the surging demand for vanadium in battery applications and acknowledge that news updates from China, the largest and most advanced vanadium redox flow battery (“VRFB”) market, can be challenging to interpret. Therefore, we aim to bridge this information gap and keep global investors informed. It is worth noting that China alone has more than 2.5GWh of VRFB projects under construction in 2023, as highlighted in the article below. This alone represents an additional 11% of annual vanadium demand.

Additionally, Finland recently designated Neometals' project as a crucial critical raw materials project in a report issued by the European Union. Meanwhile, Australia is providing A$49 million in support to the Australian Vanadium project, with the aim of fostering an Australian vanadium battery industry. Vanadium is truly advancing fast on the global stage.

I would like to take this opportunity to emphasize the comprehensive 25-page report LPV has commissioned on the vanadium industry, covering aspects such as supply, demand, and key trends. This report is readily available for free download to anyone who registers for LPV's newsletter, providing valuable insights into the industry.

On behalf of LPV, I extend my gratitude for your continued support, and I eagerly look forward to providing you with our next update in the coming month.

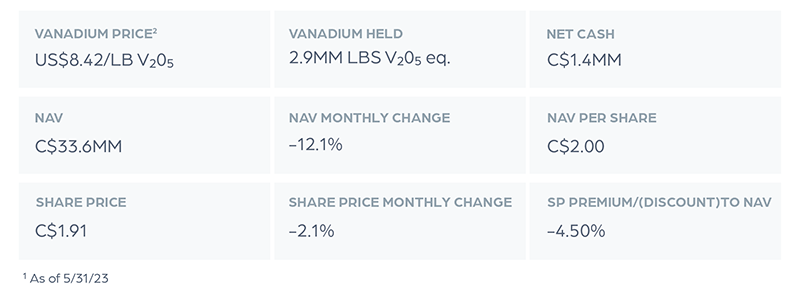

Largo Physical Vanadium Update - May 2023¹

LPV’s net assets are over 90% held in physical vanadium products. LPV’s net asset value (“NAV”) is now at C$2.00/share, implying that our closing share price as of May 31, 2023, was trading at a 4.5% discount.

Based on the NAV to share price discount discussed in our last note, we continue to believe that this investment offer is even more attractive to current and potential LPV investors. A number of corporate initiatives and a marketing campaign are currently underway to raise awareness of LPV and close the valuation gap.

Upcoming Conferences:

International Flow Battery Forum

Monday, June 26 - Thursday, June 29, 2023

Prague, Czech Republic

REGISTER HERE

Rule Symposium - Natural Resource Investing

Sunday, July 23 - Thursday, July 27, 2023

Boca Raton, Florida, USA

REGISTER HERE

Largo Physical Vanadium Announces U.S. Listing on OTCQX Under the Symbol VANAF

Australian Vanadium executes $49 million Federal grant to support domestic vanadium battery industry

Finnish vanadium project classed as 'critical'

Vanadium electrolyte: the ‘fuel’ for long-duration energy storage

Invinity Energy secures 0.88 MWh battery sale to Detroit workers union

Largo Physical Vanadium Announces the Appointment of Erik Bethel to its Board of Directors

About Largo Physical Vanadium Corp. |

Largo Physical Vanadium Corp. (LPV) is a pure-play physical vanadium investment company. LPV provides direct exposure to vanadium through a secure, convenient and exchange-traded vehicle. Vanadium is essential to achieving a greener world, though carbon reduction, in key industries such as steel, aerospace and energy storage. LPV's strategy is to achieve appreciation through the acquisition of vanadium as well as actively supplying the fast growing vanadium redox flow battery (VRFB) industry to advance the integration of renewable energy in long duration storage. LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com Paul Vollant, ¹ Key Metrics (as of April 30th, 2023 closing) ² LPV’s marked to market average vanadium price blending various products and geographies |