January Monthly Vanadium News

I am pleased to provide you with exciting vanadium market updates and LPV progress over the last few months.

January 2023 was marked by a continued increase in vanadium prices globally. Vanadium prices went up by approximately +6% this month and +29% since our inception in late September 2022

The rise in vanadium price was supported by strong news flow from the energy storage industry, particularly in China. Following the commissioning of the largest (100MW/400MWh) vanadium redox flow battery (VRFB) in Dalian, China in 2022, several battery and electrolyte projects greater than 100MWh were announced over the past couple months (see News below). As a reference, each 200MWh of battery capacity equates to approximately 2,000mt of V2O5 equivalent or 1% of global production. Estimates for 2023 are as high as 2 GWh of total new VRFB projects, representing approximately 10% of global vanadium production and more than double the total installed capacity since the 1980s. These projections have the potential to fundamentally transform the vanadium industry.

Demand from other key markets (steel, aerospace and chemical) has also been stronger than expected only a couple of quarters ago.

On the supply side, primary producers Largo Inc. and Bushveld Minerals Ltd. announced lower than guidance 2022 production, while large producers in China are reducing output in the early months of the year.

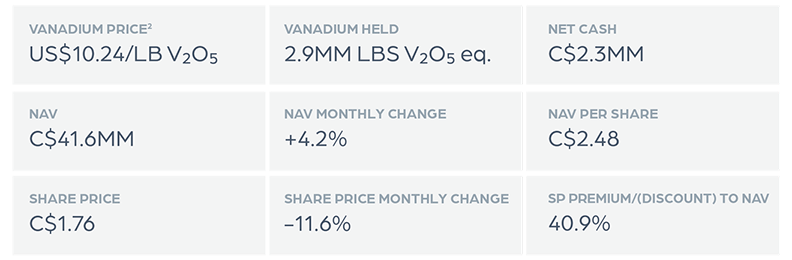

LPV’s net assets are now over 90% held in physical vanadium products and near-term delivery commitments . LPV benefited from the fact that its launch in September 2022 coincided with a period of lower vanadium prices, which enabled LPV to purchase vanadium units at favorable market conditions. Our NAV is now at C$2.47/share, or 24% above go public transaction price of C$2.00/share, and 40% above the closing share price of C$1.76 per share on January 31st, 2023.

We believe this NAV to share price discount offers current and new LPV investors an even more attractive investment case. Closing this strong disconnect is now our key focus. We are working on a broad marketing and communication campaign to raise awareness of the investment proposal of LPV.

On behalf of LPV, I thank you for your support and look forward to providing a new update next month.

Paul Vollant,

CEO & Director

Largo Physical Vanadium

January Monthly Update¹

Recent Vanadium News

The Raw Material Needs of Energy Technologies

China's V demand from non-steel sectors to rise in 2023

Bushveld Minerals: Q3 2022 and 9M 2022 Operational Update

About Largo Physical Vanadium Corp. |

LPV's common shares trades on the TSX Venture Exchange under the symbol "VAND". For more information, please visit www.lpvanadium.com Paul Vollant, ¹ Key Metrics (as of January 31, 2023 closing) |