December Monthly Vanadium News

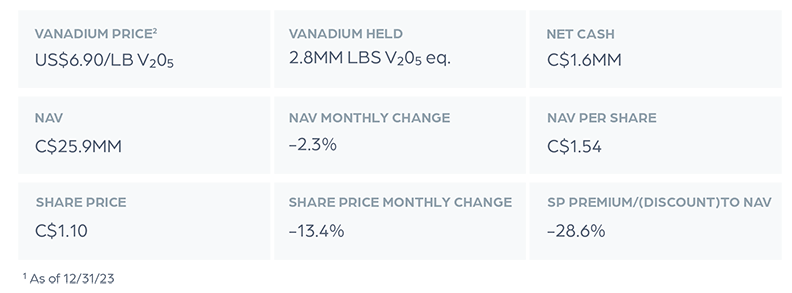

As the end of another transformative year passes, it is imperative to reflect on the significant strides made in the vanadium sector. Our journey in the vanadium landscape has been marked by strategic developments and global advancements, underscoring the commitment to fostering sustainable energy solutions. Navigating the Future with Vanadium: December Insights In December, the landmark investment by Zhonghe Energy in a 1GWh vanadium flow battery energy storage system production base in Shanxi Province, China for , stands as a testament to the growing global demand for vanadium-based energy storage solutions. In another significant development, LIVA, a subsidiary of AMG, has acquired VRFB assets from Voith. This acquisition is a strategic expansion into advanced technologies for large-scale high-voltage VRFB. This move not only enhances LIVA's technological portfolio but also underscores the ambition of AMG in the global energy transition narrative. Last month, VanadiumCorp also announced the completion of its electrolyte-processing plant in Québec and Australian Vanadium completed its electrolyte factory in Western Australia. Both these facilities will further augment the global vanadium electrolyte supply chain with local players servicing regional demand. It is important to note that these facilities have been backed by governmental support, in a clear indication of the recognition and importance of vanadium in national energy strategies. Finally, the agreement between Bushveld Minerals Ltd and Southern Point Resources Ltd, reflects the long term view of financial investors that are looking past the current difficult price environment. In summary, the events of December have not only reinforced the critical role of vanadium in the renewable energy sector but also highlighted the increasing global engagement in this arena. As Largo Physical Vanadium, we remain at the forefront of these developments, ensuring our strategies are aligned with these global trends and our commitment to sustainable and efficient energy solutions remains unwavering. As we step into the new year, I wish you all a very happy 2024 and look forward to continuing our journey together. Largo Physical Vanadium Update – December 2023¹ LPV’s net assets are over 95% held in physical vanadium products. LPV’s net asset value (“NAV”) is now at C$1.54/share, implying that our closing share price as of December 31, 2023, was trading at a 28.6% discount.

| ||